U.S. Economy is Mexico’s Lifeline

Warning: foreach() argument must be of type array|object, bool given in /home/mexiconow/public_html/sites/mexiconow/wp-content/themes/mexiconowwpnew/single.php on line 176

By Nancy J. Gonzalez

The U.S. recovery is helping the Mexican economy. After the hit of the COVID-19 pandemic, Mexicans living abroad sent more remittances while the demand of vehicles forced the Mexican automotive manufacturing sites to increase the production after a two-month shutdown. These trends are helping the Mexican economy to recover quicker than expected.

Mexico is linked to the U.S. through many channels because large parts of the Mexican economic performance depend on the U.S. economy.

Indeed, the Mexican economy collapsed 10.5% year over year (yoy) in the first half of the year. However, there was recovery in June 2020 and some growth in the second half of the year, says a Bank of America Global Research analysis.

“We forecast 0.2% growth in the second half of 2020 versus the first half 2020 and then 2% growth in 2021,” wrote Carlos Capistran, Canada and Mexico Economist for Bank of America and author of the analysis. “One of the most important (external factors) for the Mexican economy is the speed of the U.S. economic recovery and the impact it can have on the Mexican

economy.”

The document says the Mexican economy is still at risk due to domestic reasons such as limited COVID-19 testing, limited fiscal stimulus, relatively high interest rates, but the external factors, such as the U.S. recovery, have a greater impact economically speaking.

“The Mexican economy is benefiting from the upturn in the U.S. business cycle, mainly through the U.S. demand for Mexican exports and remittances sent by Mexican migrants working in the U.S.,” Alfredo Coutino, an economist at Moody’s Analytics, expressed in a research note.

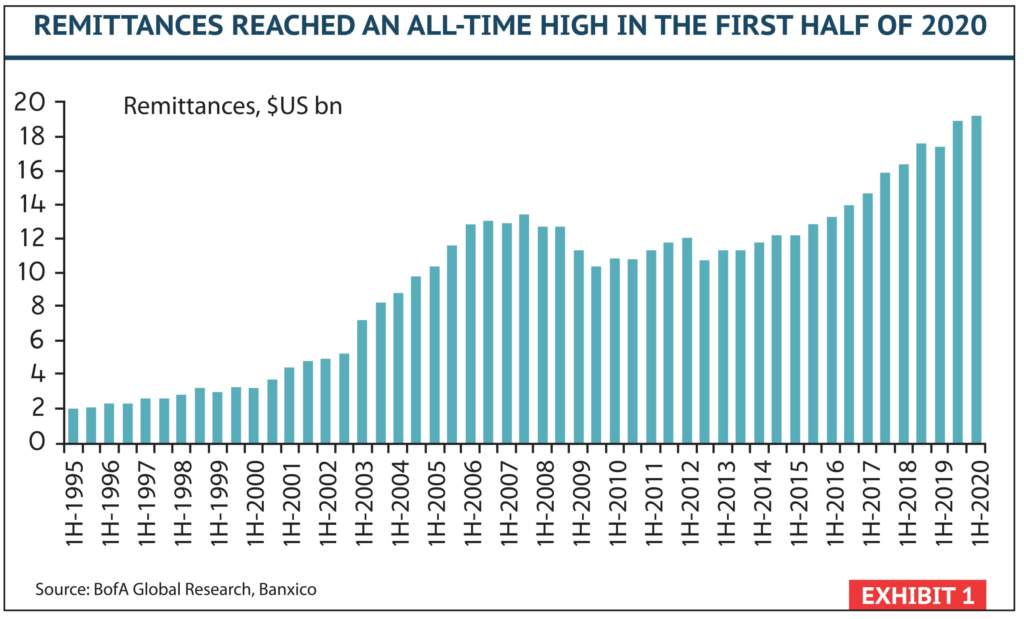

Remittances had a crucial role on this economic recovery. The BofA analysis saws that even though U.S. unemployment rate soared from 3.5% in December 2019 to 11.1% in July 2020, remittances to Mexico surprisingly grew 10.6% yoy in the first half of the year, reaching an all-time high at US$19.1 billion. (Exhibit 1)

The correlation is that typically U.S. employment is an important determinant of remittances.

“Solid workers’ remittance flows have been adding support to the current account and to private consumption, particularly for lowincome families, who have a high propensity to consume and are the overwhelming recipients of such transfers,” said Goldman Sachs economist Alberto Ramos.

The economist said Mexico was still heavily reliant on the U.S. economy, and forecast the recovery would slow in the months ahead.

Remittances are only 2.9% of Mexico’s Gross Domestic Product (GDP), but are 4.4% of consumption and have an above-1 multiplier, so this is an important lifeline, the analysis explained.

Alberto Laureano, Barri Financial Group CEO -a financial group that handles remittances in 37 U.S. states- said many Mexicans living in the U.S. looked for essential jobs to secure an income during this pandemic; therefore, they were able to continue sending money back home.

“Mexican migrants have had an income because they have reinvented

themselves and employed in essential jobs. For example, Texas government

said construction was essential and many migrants are employed in this industry,” he added.

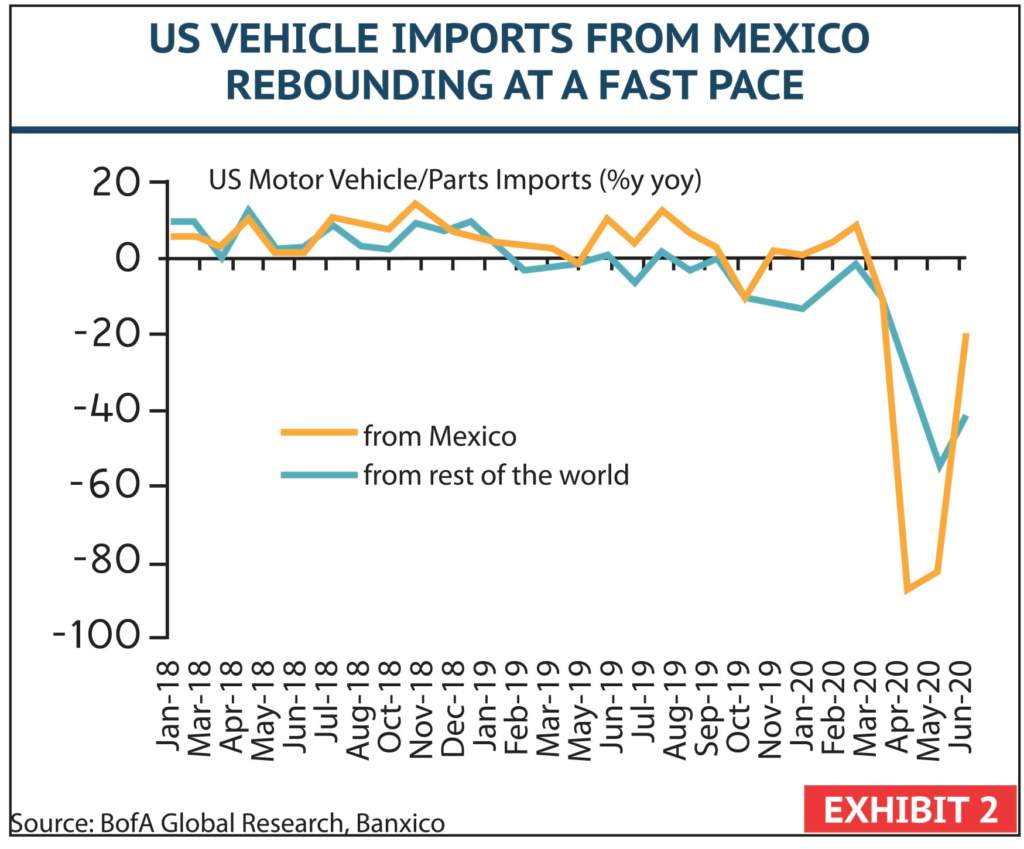

But the U.S. is helping Mexico through other channels, such as auto exports from Mexico to the U.S., which are almost back to prepandemic levels despite falling more than 90% yoy in April and May.

After the shutdown in April and May, the OEMs in Mexico have increased their production up to the pre-pandemic levels due to the high demand for vehicles in the U.S., especially for pickups and the premium sector.

Some OEMs have increased their production after the shutdown above the 300,000 units per month, the average production in 2019. Audi, BMW, GM, Mazda, Mercedes Benz, Toyota and VW are helping to increase the average vehicle production numbers in Mexico. The most recent INEGI data shows an 8% production increase in October 2020, if compared to the same month in 2019.

The manufacturing sector represents 16% of GDP and most manufacturing exports go to the U.S.

The BofA report says U.S. imports of Mexican auto and auto parts is recovering faster than U.S. imports from other countries and the USMCA might be a positive factor for this trend. (Exhibit 2). Overall, Mexican exports to the U.S. are rebounding nicely.

After falling sequentially in March, April, and May, U.S. imports from Mexico finally increased 65% month over month in June. Again, the large fiscal stimulus in the U.S. may be playing a role here as it did in the remittances.

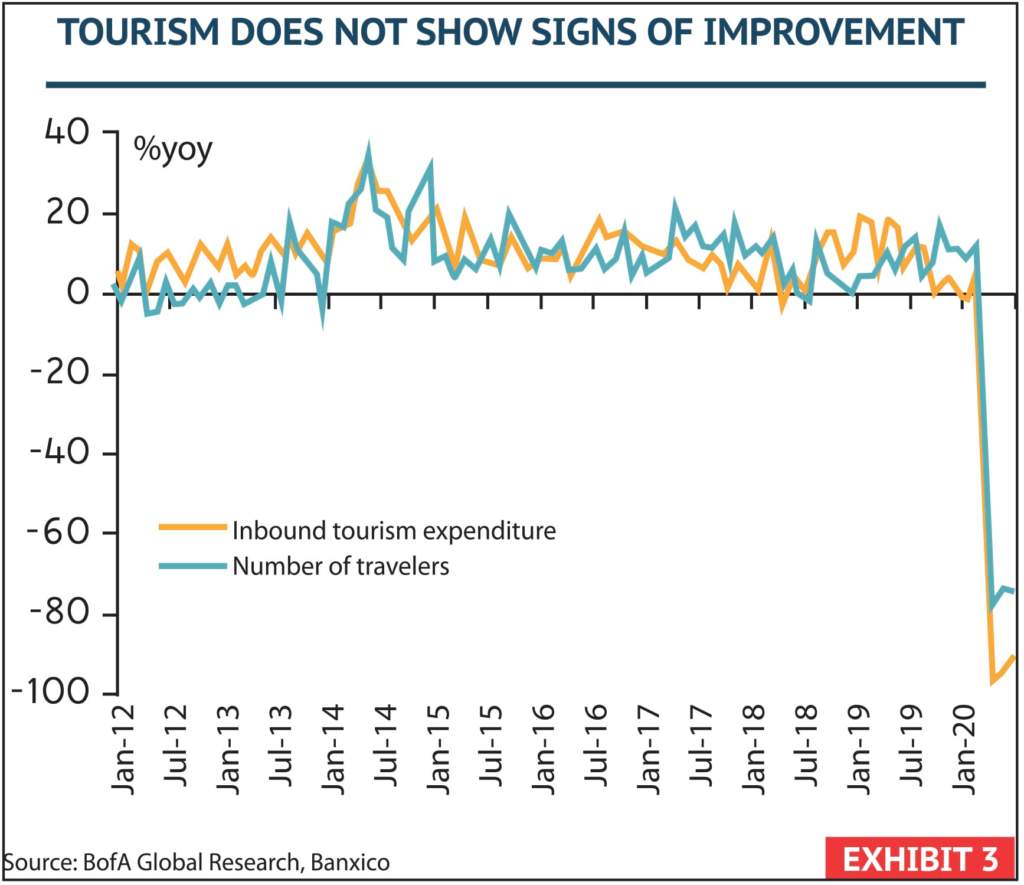

Perhaps the most important sector that will lag the recovery is tourism. This industry contributes 8.7% of the GDP, with a large contribution from U.S. citizens visiting Mexico every year.

It is a large part of the Mexican economy but the pandemic and the global and the local lockdowns have impacted it severely. Expenditure by foreign tourists is down 90% yoy in June and the number of travelers is down 74% yoy with data up to May. (Exhibit 3).

“Given the relatively high number of COVID-19 cases and deaths in the U.S. and Mexico and the very limited testing in Mexico we believe the sector will take many years to recover to pre-COVID levels, and it will continue to be one of the main drags of the recovery in Mexico,” Capistran said in his report.

The BofA report says the aid the U.S. economy is providing to the Mexican economy puts upside risks to the BofA GDP growth expectations for the second half of 2020 and 2021 to 0.2% and 2%, respectively.

Even though the U.S. recovery is helping the Mexican economy, economists believe the Mexican economy recovery is going to be weak in the long run because of the lack of virus containment, limited fiscal stimulus, uncertainty for investors and high interest rates. Also, external factors such as the lack of an effective treatment for COVID-19 and the need for a vaccine come into play.

“Overall policies in Mexico are not conductive to investment and now foreign direct investment is beginning to join portfolio investment’s weakness, which in turn are joining the weakness in domestic investment,” the BofA report highlights.

Economists said Mexico should remain vigilant and work on its domestic issues because the new waves of the virus can further slowdown the U.S.

economy and hence the Mexican one.