Prospects for Foreign Direct Investment in Mexico 2021

Warning: foreach() argument must be of type array|object, bool given in /home/mexiconow/public_html/sites/mexiconow/wp-content/themes/mexiconowwpnew/single.php on line 254

By Iván Iglesias

According to different analysts and statistical data, an economic recovery and a higher level of foreign investment to Mexico is predicted for 2021. However, FDI (Foreign Direct Investment) is conditioned to the possibility of new “waves” of COVID-19, along with the recovery of business confidence and a greater sensitivity on the part of the government towards the needs of the foreign private sector in Mexico.

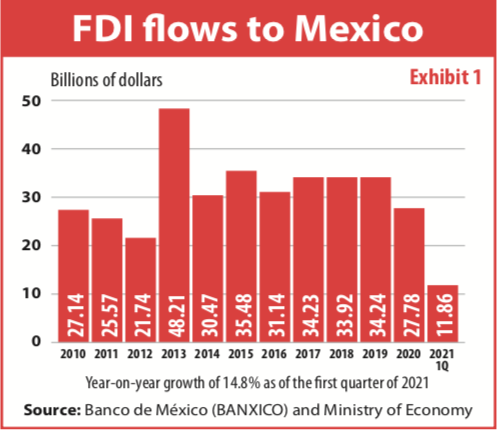

The analysis is as follows: Following the economic numbers presented by BANXICO and the Ministry of Economy at the end of last year, during the concentrated period 2010-2020, FDI in Mexico presented a growth of 2.3%, going from US$27.14 billion in 2010 to US$27.78 billion in 2020, while for the first quarter of 2021 FDI reached US$11.86 billion, which represents an increase of 14.8% compared to the first quarter of 2020.

However, this figure of US$27.78 billion represented a decrease of 18.8% compared to 2019. “This contraction is associated with the pandemic,” explained the analysis carried out by the consulting firm Salles Sainz Grant Thornton. In fact, the United Nations Conference on Trade and Development (UNCTAD) estimated that in 2020 global FDI flows decreased 42%, compared to 2019, according to the “World Investment Report” published in January 2021, which shows that Mexico had a better performance attracting FDI compared to the rest of the world.

According to the report on FDI presented by the SE, these US$11.86 billion in the first quarter of 2021 were reported by 1,872 companies with participation of foreign capital, 883 trust contracts and nine foreign legal entities.

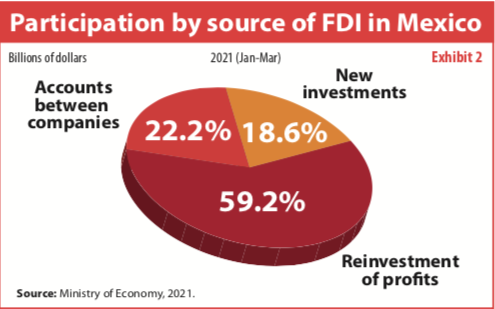

The SE report further shows that the main element of FDI in the first quarter of 2021 has been thanks to the reinvestment of profits, US$7.02 billion (59.2%); for accounts between companies, US$2.62 billion (22.2%), and for new investments or equity only US$2.20 (18.6%).

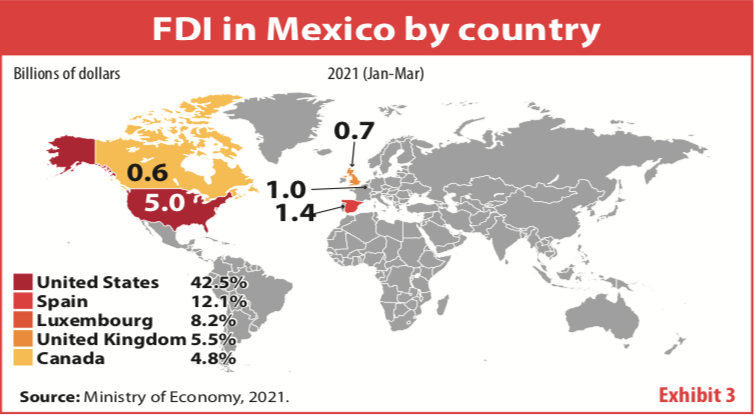

When referring to the origin of the investments, the SE report indicates that the main country from which Mexico has received FDI is the United States, US$5.04 billion (42.5%), followed by Spain, with US$1.43 billion (12.1%); Luxembourg, with US$0.96 billion (8.2%); the United Kingdom, with US$0.65 billion (5.5%); Canada, with US$0.56 billion (4.8%), while other countries added the remaining 26.9%.

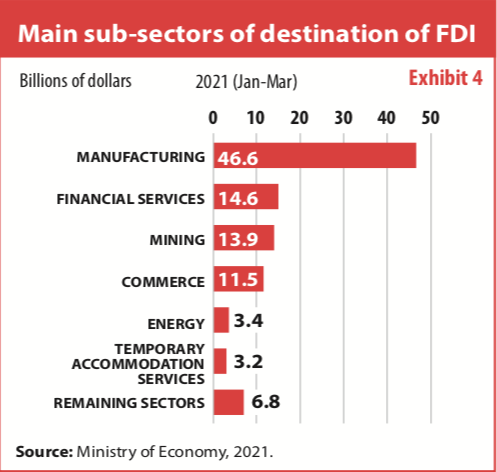

The main destination of FDI flows is the industrial sector, with manufacturing being the main destination subsector (46.6%). Following these two are the financial and insurance services sector (14.6%), mining (13.9%), commerce (11.5%), energy (3.4%) and temporary accommodation services (3.2%). The remaining sectors captured 6.8%.

Pandemic reality, reshoring and expectations

The COVID-19 conjuncture has caused a deep economic crisis, which has affected global FDI. According to the Economic Commission for Latin America and the Caribbean (ECLAC), in its report “Foreign Direct Investment in Latin America and the Caribbean, 2020,” because of the pandemic, most of the world’s productive sectors were hit in a generalized way, which successively extended to cross-border investments, which could register a reduction of between 30% and 40% at the end of 2021.

According to the cited ECLAC document, among the transformations that global value chains will undergo in the next decade, the withdrawal, to varying degrees, of international production can be considered, which has as a consequence a decrease in foreign investment, while paying special attention to national relocation (reshoring).

This relocation could become very relevant for high-tech industries. But specifically, in the automotive sector, this point is ambivalent: the high amount of investments already made in the main Latin American countries that produce vehicles (Brazil and Mexico) and the degree of technical preparation achieved by their workforce generate a high level of territorial roots that make the return of these industries to their countries of origin unlikely.

But, on the other hand, according to experts in this sector, the level of FDI will not increase in 2021 as investments are already in Mexico. According to Fausto Cuevas, general director of the Mexican Association of the Automotive Industry (AMIA), it will be difficult to see large investments in the assembly plants in 2021, except for the investments that are made annually for the change of production lines, of new models or changes in the current ones. For Cuevas, although the automotive industry, having been considered an essential activity, was not totally affected by the pandemic, significant investments in the country have already been made in the last 10 years, coming from automakers such as Kia (Nuevo León) , Toyota (Guanajuato) and BMW (San Luis Potosí), which, he said, “are still in the process of maturing.”

Under this conservative economic context, “expectations regarding FDI to Mexico for 2021 are expected to recover,” according to the consulting firm Salles Sainz Grant Thornton, positioning what was reported by BANXICO in February 2021 (US$26 billion) as the average expectation for 2021.

Is there confidence to invest?

According to AT Kearney, a company that annually prepares its world FDI confidence index, in 2020 the ranking of the most reliable countries to invest is led by the United States, Canada, Germany, Japan and France, Mexico (which was in position 25 in 2019) was left out, attributing it to the prioritization of investments with low economic and social impact, changes in the energy sector and project cancellations.

In this sense, AT Kearney affirms that the recovery of the global economy after COVID-19 is fundamental for attracting FDI to Mexico; however, “internal economic conditions will also be relevant to generate greater confidence for investment in the country.”

According to ECLAC, the benefits of FDI will be obtained when the policies to attract FDI are integrated and coordinated with the development policies of a country (in this case, Mexico). “Although FDI alone does not solve the problems related to economic growth, it can assume an important role to the extent that it is aligned with their strategic objectives,” according to their report “Foreign Direct Investment in Latin America and Caribbean.”

Are we going towards new collaboration strategies?

It should be noted that the Mexican government strategy to attract FDI has been based on the creation of a regulatory framework that offers transparency for the investor, rather than on building policies based on incentives to promote it.

“The new international scenarios make it necessary for FDI and the policies to promote it to be part of a broader project that allows social inclusion, equality and growing environmental sustainability,” said Salles Sainz Grant Thornton. But, for this, it is necessary not only to offer the conditions for foreign capital to arrive, but it is necessary to create conditions for capital to become generative sources of greater productivity, innovation and technology. In other words, a scheme of greater collaboration between government and private initiative is greatly needed. Will we see it in 2021? .