The Business “New Normal” in Mexico

Warning: foreach() argument must be of type array|object, bool given in /home/mexiconow/public_html/sites/mexiconow/wp-content/themes/mexiconowwpnew/single.php on line 254

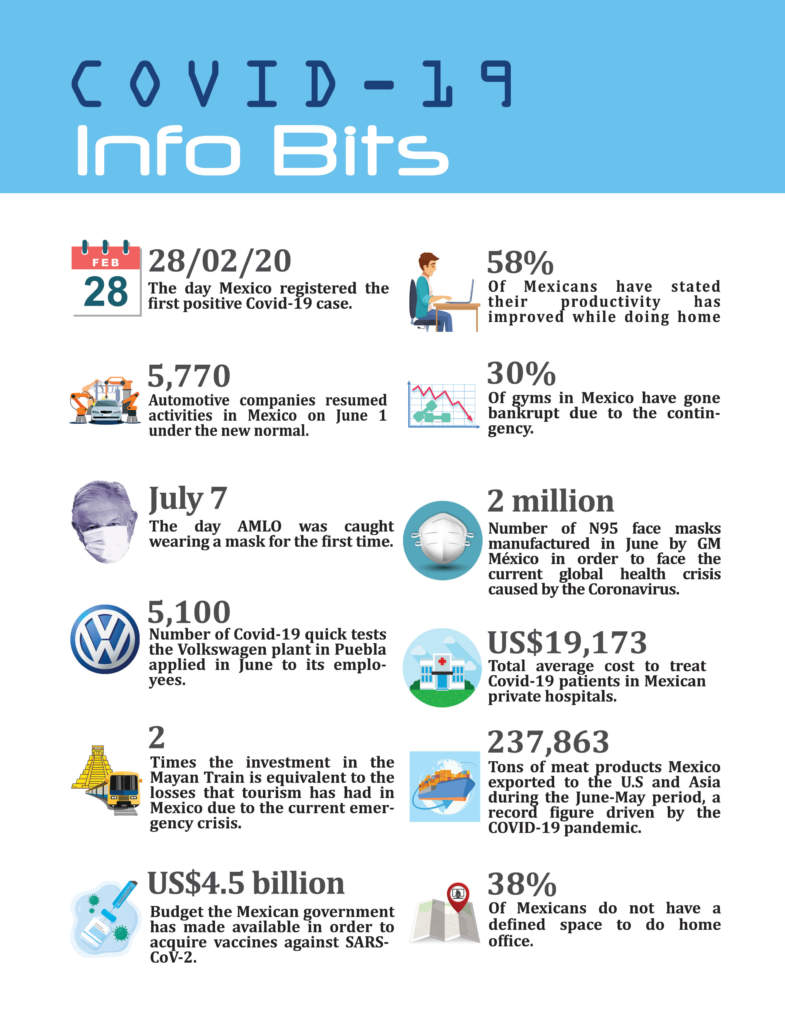

Charting the After Coronavirus Come Back

By Sergio L. Ornelas

MEXICONOW Editor

The business “New Normal” in Mexico goes beyond home office, social distancing, essential activities and face masks.

The “New Normal” is about Mexico’s businesses surviving the wrecks courtesy of COVID-19, AMLO and the economic recession.

In the Before Coronavirus (B.C.) times, Mexico was going through a mild recession and an unpredictable new federal administration. Just prior to the After Coronavirus (A.D.) era the country is starting to look in extreme disarray with seemingly endless propagation of the pandemic and dire epidemic unemployment.

Nothing is going to take Mexico “back to normal.” But through intelligent, solid and sustainable strategies and tactics, Mexican businesses, both international and domestic, may forge a “New Normal” for themselves

that may very well be better than the old normal, but it would take large amounts of resolve, work and good luck.

Just a year after winning the 2008 U.S. Open, his 14th major tournament, Tiger Woods crashed his vehicle against a fire hydrant during the holidays, apparently after fleeing the infidelity anger of his wife.

During the next 10 years or so, Tiger repeatedly touched rock bottom on the heels of more personal scandals, four back surgeries and withdrawals and cuts in golf tournaments. Many wondered if Tiger’s glory days were

over.

However, through therapies (physical and mental), training and dedication, Woods managed to win the 2019 Masters. Woods’ improbable comeback is among the top sports rebirths ever. It required innovation in playing and lifestyles, but above all, mental strength and extreme stubbornness. By creating a new normal, Woods came back stronger.

As businesses in Mexico ponder how they can recover from the damages caused by the pandemic and other disorders, Tiger’s comeback provides a point of reference of the effort needed to succeed in A.C.

In this piece, we will review some of the options and strategies businesses in Mexico may ponder and implement to forge their next “New Normal.”

Digitalize … fast

By now, most of us in the business world have learned the basics of working remotely. Home office, online meetings, home deliveries and inhouse workouts are common cores.

This was a coming trend that the pandemic simply accelerated, as it did many other things such as e-trade, safety in production lines, traveling and even remote medical consultations.

We need to realize that the business world has fundamentally changed forever, and your business needs to follow suit by digitalizing its overall model.

Please note that “digitization” is not the same as “Digitalization.” The former is simply converting data and documents from analog to digital form, while digitalization is the use of digital technologies to change a business model and provide new revenue, value-producing opportunities and cost efficiencies across the board.

For example, here at MEXICONOW, we had a two-year plan to digitalize

products, processes and operations, but when COVID-19 hit deep it became a two-month plan that included the development of business webinars, virtual events, digital distribution of publications, online editorial and advertising software, apps, and other digital tools such as collecting and

analyzing data to improve our digital presence.

All organizations currently need a digitalization plan that must be implemented quickly to cope with customers’ changing expectations.

The adoption of technologies beyond just home office capabilities is in order.

Explore how your business can use Artificial Intelligence, The Internet of Things, Cloud Computing, Manufacturing 4.0 and other technologies. Do invest in hardware and software to increase the efficiency and speed of your digital operations.

A good place to start a serious effort is to name a “Digitalization Manager” or team to design, implement and supervise your tailored digitalization plan.

Even if your organization were a digital wizard in B.C., reassess your model and capabilities; there is always room for improvement and ways to increase the speed and productivity of your digital processes and solutions.

An area of digitalization often overlooked is the transformation of domain, or the incursion in new or redefined products and services. And you do not need to be Amazon (which expanded from traditional e-commerce into one of the largest web services providers leveraging on its relationships with suppliers) to unlock new market niches and business opportunities through digitalization.

Adapt to Mexico’s Woes

While digitalization may get your enterprise through the mid-term survival threshold, in the A.C. world in Mexico, business conditions are going to be anything but normal.

Mexico’s economy will be smaller in the years to come as over 1.2 million people lost their formal jobs in the first half of 2020 and GDP for the year is expected to slump at the tone of -10.5%.

Depending on the country’s ability to tame the virus and even with a vaccine available sometime in mid-2021, optimistic analysts give it a minimum of three years for the GDP to get back to 2019 levels of production of goods and services, while others project the recovery would take five or more years.

Domestic consumer and industrial demand will vary wildly across sectors with tech and e-commerce firms fairing a lot better than hospitality and retail for example.

Mexico’s international trade is expected to recover faster than the domestic economy. In June 2020, Mexico’s exports were down 12.8% compared to the same month a year earlier, but with imports declining 22.2%, they helped the country post the largest trade balance surplus on record.

Consider the quick bounce of Mexico’s automotive export powerhouse, which came to a literal complete stop in April and May, but by July it was only 5.5% behind the same month last year in light vehicle exports.

The auto industry is expected to be practically recovered by 2022 as production and exports reach B.C. levels on the heels of the U.S. market. You may recall that the U.S. scored five consecutive years (2015-2019) above the

17 million annual sales mark. IHS Markit, a global leading consultancy, projects sales in the U.S. would be 13.2 million in 2020, 14.6 million units in 2021 and just shy of 16 million in 2022.

But inexplicable actions on the part of President Lopez Obrador (AMLO) against international investments such as the now famous Constellation brands brewery in Mexicali and various renewable projects across the country cannot get rid of the stigma that Mexico is its own worst enemy.

AMLO’s negative initiatives come as a real shock to most businesspersons in Mexico, as the country faces monumental Foreign Direct Investment (FDI) opportunities with its reborn trade agreement in North America.

In addition, the growing fracture between the U.S. and China and the need to reduce the geographical distance of supply chains position Mexico as an ideal alternative to locate manufacturing facilities to serve the U.S. and other near global marketplaces.

The Coronavirus is giving the trend of regionalization a big boost. Please remember that since 9/11 international companies started to de-globalize, shifting their manufacturing landscape from a single large producing location to smaller operations closer to the final consumers in regional markets.

Mexico is ideally positioned as the low-cost manufacturing platform of the North American region.

According to BofA Global Research, a “tectonic shift” would be happening over the next decade as supply chains and manufacturing are re-localized from East-to-West. Their reports indicate that companies in more than

80% of global sectors faced supply chain shortages during the pandemic enhancing relocation plans. Furthermore, 70% of respondents in a large survey they conducted indicated that supply chain re-shoring was their #1 priority in the A.C. world.

Companies in Mexico need to strive to be part of the value chains serving export mar kets, while the country’s federal administration should get smart and rollout the red carpet to foreign investors instead of blindingly wrapping itself in foolish and brainless actions against them, which definitely should not be part of the “New Normal” in Mexico

Risk & Flexibility

New and sudden abnormalities are certainly part of the “New Normal.” Is your company prepared for a new lockdown if the pandemic runs uncontrollably? Nobody expected the global outbreak of COVID-19 to cause such extreme economic meltdown, but we know better now, and firms must strive to reduce future risks and stay as flexible as possible.

For example, if you need to hire personnel, look for outsourcing options or pre-determined time period contracts to avoid the heavy cost of getting rid of employees in Mexico should you need to lean your workforce for any reason.

Likewise, companies in Mexico should stay “light” and flexible in their long-term commitments such as leasing of facilities, contracts with suppliers, capital expenditures and other business affairs that would be unproductive

and costly in another emergency, be it sanitary, environmental or geopolitical.

Since 9/11, the Japanese tsunami and multiple influenza breakouts, companies’ crisis management has focused on preparation. And that is fine, of course, but not enough.

In the “New Normal” in Mexico, firms must be aware that the government’s response to any crisis is politically driven and not necessarily appropriate. Mexico’s government in the case of the current pandemic was unable

to provide early disease detection, rapid testing capabilities and credible information on symptoms and how to prevent transmission.

At the micro level, the leadership of firms in Mexico needs to be prepared to fill in this inexcusable public void. For those international companies that would like to have the maximum flexibility with very low risk there is the

“Shelter” option. Under the shelter plan, a shelter operator takes care of

all the legal and administrative cores of running an operation in Mexico, including human resources, customs, logistics and taxes and the foreign firm does not have any legal presence in the country.

The shelter client typically supplies the equipment and materials and the manufacturing know-how (usually with an expatriate production manager) and does not have to worry about anything else as the shelter operator is fiscally and legally responsible for the overall operation.

There are over 10 well-proven shelter operators in Mexico and many of their clients are able to run their operation below the cost they would have in a stand-alone facility, as the shelter operator is able to accomplish economies of scale by handling various customers at the time.

Furthermore, if your firm is a standalone operation already in Mexico, there is always the potential option to convert to a shelter model under the “Shelter-back” mode, offered by most shelter operators.

International firms are well experienced in the unexpected conditions to operate offshore; COVID-19 brought a new recovery performance frontier for those who want to keep their position in the marketplace.

Mexico offers a wonderful opportunity for foreign investors to become a functional link in the north America supply chains, most importantly, in the automotive, food and aerospace sectors. Challenging and interesting developments lie ahead.

Conclusions

The next few years are not going to be easy in Mexico, business as usual will not be back as the economic climate and customer preferences have changed signifi cantly. Companies will have to carve their own “New Normal” in the marketplace by accelerating digitalization and staying flexible with minimum long-term commitments and avoiding risks.

Throw in the mix the profound turbulent politics both in the U.S. and Mexico and the outlook becomes further blurred with uncertainty.

AMLO’s approval rating was at 83% when he first took office, today it is flirting at about 50% with wide Congress and States mid-term elections set for June 2021.

He is trying to improve his popularity by sticking to his plan to make the country energy self-sufficient through intensive carbon initiatives. But his record on the pandemic, security and the economy continues to erode badly. Business leaders in Mexico are determined to deny him to extend a majority in both Congressional bodies.

The USMCA came into force just recently and includes a series of provisions to protect foreign investors through labor, environmental and arbitration clauses. Hopefully, the new trade agreement would help keep the pipeline of foreign investors flowing.